Public Banking Gains Ground Across California

THE CALIFORNIA PUBLIC BANKING ALLIANCE EXPANDS IN CENTRAL CALIFORNIA!

Welcome to Public Bank Fresno, the newest member of the growing California Public Banking Alliance! We’re excited to collaborate with you in working with local governments to establish socially and environmentally responsible public banks across California.

Led by Samuel Molina, CEO of The Academy of Financial Education, and Eric Payne, Executive Director of the Central Valley Urban Institute, Public Bank Fresno brings a wealth of expertise and passion to our shared mission.

If you’re in the Fresno or Central Valley area and interested in joining Public Bank Fresno, contact Samuel: samuel@taofe.org

CPBA SEPTEMBER 2024 CITY/REGIONAL PROGRESS REPORTS

The California Public Banking Alliance (CPBA) continues to make significant strides in establishing public banks across the state. From Los Angeles to San Francisco, local governments are pushing forward with plans to establish financial institutions that serve the people, not just profits. This update covers our latest efforts, showing our shared commitment to flipping the script on California’s financial future and making banking work for everyone.

Central Coast

The governing bodies of ten jurisdictions have approved resolutions in support of a viability study to create the bank, and officials from two other jurisdictions have expressed support for a viability study as well. Local organizers with the People for Public Banking Central Coast are currently exploring the formation of a regional green bank that could eventually transition to a full-scale public bank.

Fresno

Fresno organizers are advocating for the Fresno City Council to introduce a motion that allocates funds for a feasibility study and business plan to explore the formation of Public Bank Fresno, which would support community economic development and partner with local financial institutions and CDFIs to strengthen Fresno’s small businesses.

East Bay

In May 2024, the City of Richmond unanimously passed a resolution authorizing the East Bay Public Bank organizers to apply to the State and Federal regulators for a bank charter in their name. The Friends of the Public Bank East Bay, its Board Candidates, and CEO are continuing negotiations with Alameda County and local municipalities regarding capitalization commitments. PBEB leadership has completed a full draft of the bank’s business plan and is working with local financial institutions on initial partnership discussions.

Los Angeles

The August 2024 Public Bank LA (PBLA) Advocacy Day at Los Angeles City Hall saw strong backing from coalition leaders: Inclusive Action for the City, United Parents and Students, ACCE Action, SEIU 721, and community allies. Councilmember Eunisses Hernandez endorsed the public bank as a strategy to cut infrastructure costs, especially with the LA 2028 Olympics approaching. Following the City Council’s unanimous May 2024 vote to fund the Public Bank Feasibility Study, PBLA is now advocating for Phase 1 funding in the Fall budget, which could save the city over $1 billion annually, reduce borrowing costs, and create new revenue streams.

At the June 2024 rally at LA City Hall, the Public Bank LA coalition called on the city to establish a public bank to boost local lending power and keep profits within the community. Councilmember Hugo Soto-Martinez stressed the importance of a public bank to tackle the housing crisis, homelessness, and budget challenges, calling for reinvestment of taxpayer money into neighborhoods and housing solutions.

Sacramento

In March 2023, the Sacramento City Council approved a budget request to fund consultants to develop plans for starting a public bank in accordance with the California Public Banking Act. An updated RFQ was released by the City in August 2024.

San Francisco

Plans for the Green Bank and Public Bank were unanimously approved by the Board of Supervisors in June 2023. Currently, the San Francisco Public Bank Coalition is working with the Board of Supervisors, the Local Agency Formation Commission, and the office of the Treasurer and Tax Collector to implement the plans, including actively engaging with U.S. EPA’s Greenhouse Gas Reduction Fund awardees to seek federal funding available for capitalizing green banks.

Pomona Valley

The Study Group for Public Bank Pomona Valley has met for nearly five years, lobbying local elected officials and civic groups from three cities, promoting grassroots public bank education, and closely watching statewide efforts. We intend to be among the second tier of regions establishing local public banks and, until then, tilling the soil in preparation for guiding our cities toward this worthy goal, as well as assisting other regions in their efforts. Our members have also contributed to both the National Infrastructure Bank and CalAccount efforts.

If you’re interested in joining local or regional public banking efforts, please reach out to the organizers in your area in our contact list at capublicbanking.com/contact-us.

CALACCOUNT COMMUNITY BRIEFING – OCTOBER 1ST!

Join our virtual community briefing on October 1, 2024, at 12pm as we gear up for implementation of CalAccount in 2025! Hear from experts about why CalAccount is so important, learn about the features of the new program that will be essential to the millions of workers without access to reliable, free banking services, and get your questions answered.

RSVP for the October 1 event on Zoom HERE.

Share the invitation with your base to help make CalAccount a reality.

CALACCOUNT MEETINGS IN SACRAMENTO & LOS ANGELES

Union members and community leaders gathered in Los Angeles and Sacramento to demand a fair banking system for all, including working-class people, people of color, and immigrants. In LA, we briefed SEIU 2015 workers and community memberes to prepare them for public comment.

Workers shared stories about the impact of bank fees, highlighting the need for fee-free banking. Nearly 8 million un/underbanked Californians could save $3.1 billion annually, generating $5 billion in economic activity. We’ve advocated for free checking accounts with debit card access for all 40 million Californians. The RAND study confirms that CalAccount is feasible. Read the report here: Banking the Unbanked: CalAccount Market Study and Feasibility Assessment.

The struggles of workers fuel our mission to remove banking barriers. We’re grateful for the powerful testimonies from the California Fast Fod Workers Union and SEIU Local 2015. It’s time to eliminate these barriers for all Californians.

If you haven’t already endorsed CalAccount, join over 250 organizations in support of free banking!

ENDORSE CALACCOUNT

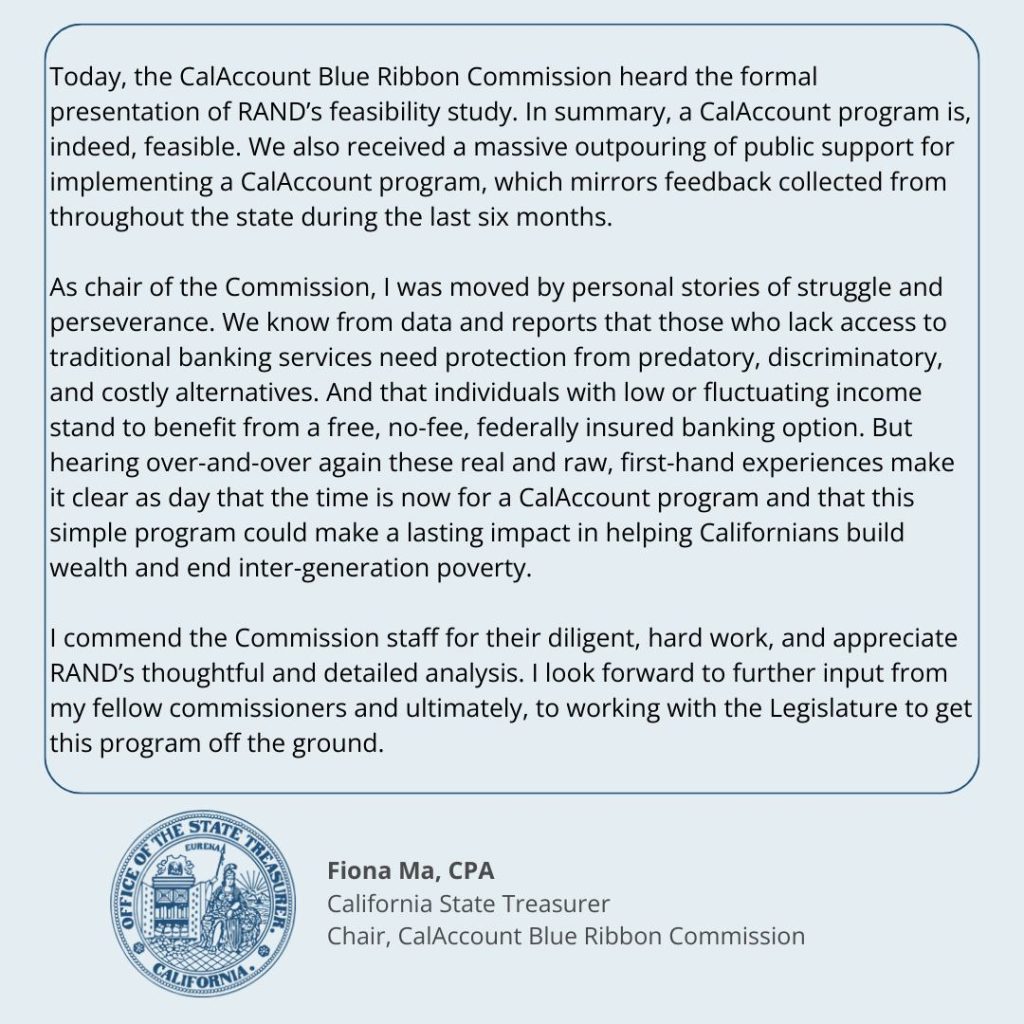

STATE TREASURER BACKS CALACCOUNT

State Treasurer Fiona Ma supports CalAccount, recognizing its feasibility and urgent need. CalAccount is essential to protect Californians from predatory financial practices, offering everyone a fair shot at building wealth and breaking the cycle of poverty. We look forward to working with the Legislature to make this program a reality.

“In summary, a CalAccount program is, indeed, feasible. We also received a massive outpouring of public support for implementing a CalAccount program, which mirror feedback collected from throughout the state during the last six months.

… But hearing over-and-over again these real and raw, first-hand experiences make it clear as day that the time is now for a CalAccount program and that this simple program could make a lasting impact in helping Californians build wealth and end inter-generation poverty.”

– California State Treasurer, Fiona Ma

BRIDGING THE GAP BETWEEN CLIMATE & ECONOMIC JUSTICE

CalAccount is a game-changer for economic and climate justice in California. With 1 in 5 households unbanked or underbanked, vulnerable communities are hardest hit by climate disasters. CalAccount provides a free public option for basic financial transactions, helping low-income and communities of color build resilience against climate shocks. It could save Californians $3.3 billion in fees and interest, benefiting both wallets and the environment.

Check out the latest from the Alliance’s Legislative Director Sylvia Chi for Just Solutions: How a Public Option for Basic Financial Transactions Supports Household Climate Resilience.

CALIFORNIA STATE PUBLIC BANK REPORT

“The Case for California’s State Public Bank,” authored by Neha Singh of UC Berkeley’s Goldman School of Public Policy, supported by the California Public Banking Alliance and Rise Economy, outlines a plan to transform the Infrastructure Bank (IBank) into the California State Public Bank. Modeled after the Bank of North Dakota, this strategy aims to enhance local economic resilience through strategic partnerships while expanding IBank’s mission to include affordable housing, green energy, and economic development. The report also calls for governance reforms to ensure transparency and efficiency. A California State Public Bank would be a cornerstone of the state’s economic framework, advancing sustainability and social justice.

Read the report:

Download the state bank report

Read the press release

Follow us @capublicbanking on Twitter, Instagram, and Facebook.

capublicbanking.com

CPBA Advocacy Team: Julian LaRosa, Lovoy Mejia, Trinity Tran, Debbie Notkin, Sylvia Chi, Rick Girling, Goli Sahba, Brett Garrett, Doug MacPherson.

CPBA Advocacy Team: Julian LaRosa, Lovoy Mejia, Trinity Tran, Debbie Notkin, Sylvia Chi, Rick Girling, Goli Sahba, Brett Garrett, Doug MacPherson. California Public Banking Alliance at the NCRC Conference with Rise Economy.

California Public Banking Alliance at the NCRC Conference with Rise Economy. Oakland CalAccount Town Hall

Oakland CalAccount Town Hall Los Angeles CalAccount Town Hall

Los Angeles CalAccount Town Hall